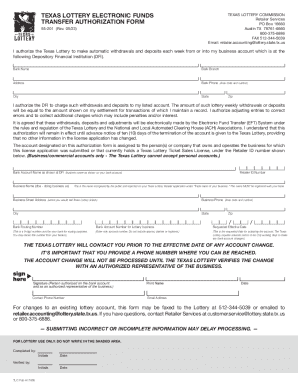

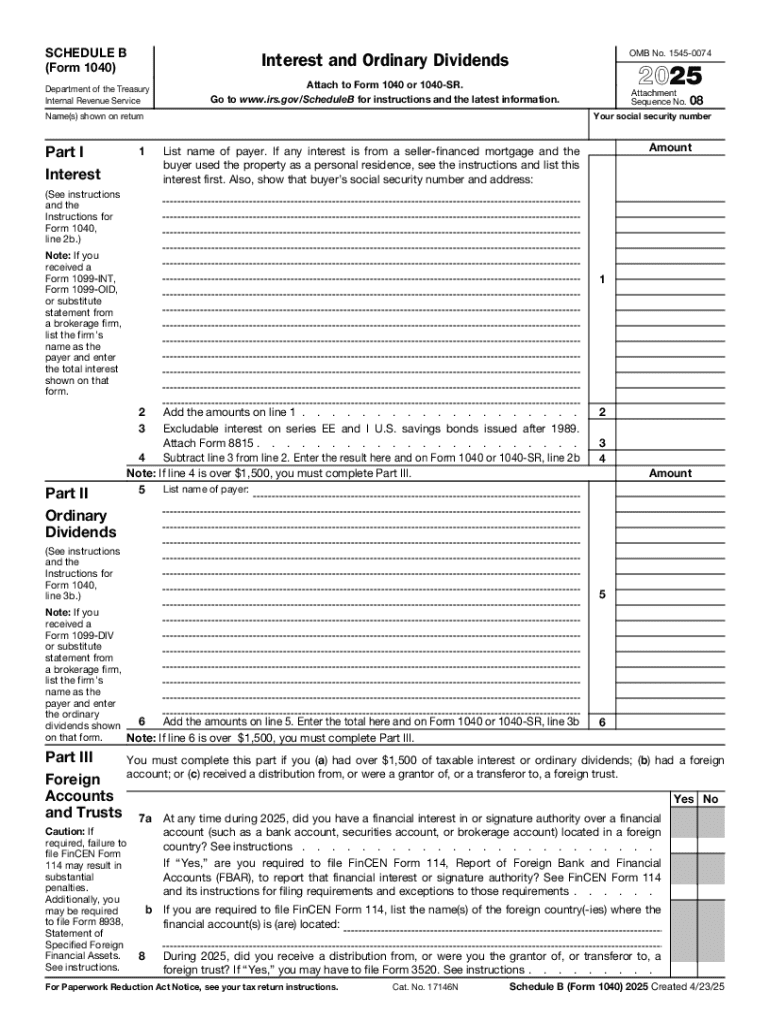

IRS 1040 - Schedule B 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

Latest updates to IRS 1040 - Schedule B

All You Need to Know About IRS 1040 - Schedule B

What is IRS 1040 - Schedule B?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule B

What should I do if I find an error on my submitted IRS 1040 - Schedule B?

If you discover an error on your IRS 1040 - Schedule B after submission, you can file an amended return using Form 1040-X. It’s essential to do this promptly to correct any mistakes that might affect your tax liability or refund amount.

How can I check the status of my IRS 1040 - Schedule B after filing?

You can check the status of your IRS 1040 - Schedule B using the IRS 'Where's My Refund?' tool if you're expecting a refund. For e-filed returns, you may also receive notifications regarding processing issues or acceptance status through the software you used.

What are the common mistakes that filers make on the IRS 1040 - Schedule B?

Common mistakes on the IRS 1040 - Schedule B include omitting interest or dividend income, errors in reporting amounts, and failing to check the boxes regarding foreign accounts. Double-checking your entries can help avoid these pitfalls.

How do I handle a notice from the IRS regarding my Schedule B?

If you receive a notice from the IRS regarding your Schedule B, read it carefully to understand the issue. Gather any requested documentation and respond by the deadline specified in the notice to ensure compliance and avoid further complications.

What should I consider regarding e-filing my IRS 1040 - Schedule B?

When e-filing your IRS 1040 - Schedule B, ensure your software is compatible and meets all IRS technical requirements. Also, be aware of potential service fees and check for any common e-file rejection codes to address issues promptly.

See what our users say